With more than $3 trillion in foreign currency reserves, China has become the world's biggest lender, outpacing even the World Bank in loans to developing countries.

As part of a VOA series on China’s economic influence, Mil Arcega examines Beijing’s foreign reserves and the debate over the true value of its currency.

If the global economy were the board game Monopoly, China would have the largest share of cash. The United States, with one fourth of the world's gross domestic product, would own most of the properties.

But because the United States borrows 40 cents of every dollar it spends, much of what it earns goes toward paying the interest on its loans, much of it held by China.

Domenico Lombardi is an international monetary expert at the Brookings Institution in Washington.

"Clearly, China has become the most important creditor to the United States," Lombardi says."This enables China to exert significant pressure in bilateral talks and we’re seeing that in the context of the U.S.-China bilateral relationship."

Former World Bank Director for China Yukon Huang is an Asia expert at the Washington-based Carnegie Endowment for International Peace.

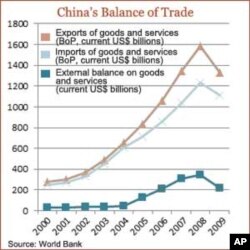

"It's now the second largest economy; it's the world's largest exporter. And people forecast in 10 years or 15 years, it will be the world's largest economy."

"The growth of the Chinese economy has been really supporting the growth of the global economy as a whole." he says.

Lately, China has been wielding its influence by investing in debt-troubled Greece, mindful that a European economic crisis could undermine its export-driven economy.

The cost of cheap currency

But China's monetary policies have come under fire. Critics say Beijing undervalues its currency to make its exports cheaper. Despite China's pledge to reform its exchange rate last year, the yuan has risen five percent against the dollar.

The United States says Beijing's undervalued currency accounts for its large trade deficit with China and the loss of thousands of American manufacturing jobs.

But the Carnegie Endowment's Yukon Huang says a stronger Chinese currency would eliminate the market for its low-cost goods, forcing China to adopt the Japanese model: competing against the United States in high-end markets and technology goods.

"So a higher exchange rate, in my view, actually creates more trade friction with the United States rather than less," says Huang. "It actually makes the American consumer probably worse off rather than better. But who would benefit from this higher exchange rate? Other emerging market countries."

Instead of creating jobs in the United States, Huang says, American companies would find cheap labor elsewhere.

"They're not generating jobs in the United States because these parts and components are being produced everywhere -- including China -- so Americans don't actually feel the benefits, the day-to-day benefits among its people. But these companies make a fortune,” he says.

China's rich, poor gap

But analysts think China's cheap currency is one reason why it is one of the world's poorest countries. China's per capita gross domestic product is only $4,000 per year, with the gap between the rich and poor growing and inflation rising.

Economist Domenico Lombardi warns that could mean trouble for China, pointing out that the current model is not sustainable.

China's central bank says more exchange rate reforms might be necessary to address these problems. It is also trying to diversify its foreign debt holdings to make the yuan a stronger alternative to the euro and the dollar.

But underscoring its unique place in the world is China's own admission that its continued economic success requires a healthy global economy -- one that's able to buy the goods it produces.