The 24-member board of the IMF approves billions of dollars in loans for countries hit by the global financial crisis.

A third of its seats are held by European countries, including small ones like Belgium and the Netherlands.

But that’s expected to end.

The IMF is committed to broadening the influence of the developing countries on the board, with Europe under pressure to give some of its seats to other countries.

Soren Ambrose is the development finance coordinator for ActionAid International.

He says originally, the executive board had only 20 members, and an agreement to keep the number at 24 has to be renewed every two years. The US says it will not agree to a renewal unless the Europeans agree to change their representation on the board.

If a decision is not made by the end of October, the board could become smaller.

"If no action is taken," he says, "we would lose four seats on the board automatically, the four smallest in terms of voting power– India, Brazil and Argentina. [They’re] all members of the G20, who have reasons to say they are important and need representation on the board.

"The fourth on the board belongs to 23 sub-Saharan African countries, and it would be unwise for the IMF to exclude African countries which have been taking out loans most consistently for last 30 years."

Reforms would likely favor middle-income countries like Turkey and the Philippines and not the poorest of the poor. That’s because, he says, votes on the IMF board are apportioned according to a country’s “relative weight” in the global economy. In his view, the least developed countries of the world have a meager voice on the board and could even have that diluted by future reforms. Middle income countries currently on the 24-member board include Thailand, Egypt, Iran and India.

He says ActionAid would rather see voting weight based on a country’s population and on the support they’ve provided the IMF through repayments of loans.

"The reason we say [a revised board should] take loans into account," he says, "is that for many years, the IMF survived on the repayments being made by (developing) countries taking out loans. So if they were to get credit for all they’ve paid in like interest payments and so on, that would increase their voice."

Also up for discussion are improvements in loans to the developing countries and the anticipated introduction of what’s being called a Global Stabilization Mechanism, which would make large amounts of money available on short notice to a number of countries at once in the case of a pending global economic collapse.

"It would be collective action backed by the board of the IMF," says Ambrose, "and, by doing many countries at once, try to restore confidence in the entire system. It means the IMF is not trying to [publicly] identify a country’s weaknesses, acting like a credit rating agency, but instead be a more systemic fixer of the entire global economy."

Participants are also expected to discuss ways of boosting growth.

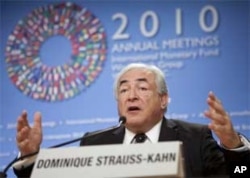

Some countries are trying to boost growth by devaluing their currency, thus making their exports cheaper. IMF Managing Director Dominique Strauss-Kahn warns that a race to lower exchange rates could destabilize the world economy.

Participants will also discuss whether the international community should boost economic growth by continuing to spend tax payer funds to stimulate their economies and provide jobs, or whether they should promote private sector growth by cutting spending and paying off debt.

Ambrose says the decision will ultimately affect developing countries.

"They rely on demand coming from the richer countries for the products they export," he explains.

"If the [industrialized] economies are slowing down and there’s not as many people working and consuming, then they are not buying [from poorer countries] coffee, or the cotton for their clothing, and the prices for thea commodities go down. That’s what affects Africa, Latin America and Asia."

New ideas could emerge through some of the week’s lectures and panel discussions. Among them are ways to jump-start job creation and a look at some of the challenges facing emerging market economies.

Ambrose says it’s not clear if any consensus will emerge from the meetings. If not, he says, the debate on many of the issues, including reforms of the IMF governance board, will continue in November at the meeting of G20 in Seoul, South Korea.