The co-founder of Apple thinks the technology company should pay more tax.

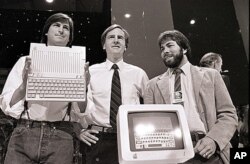

Steve Wozniak, who founded Apple with Steve Jobs and Ronald Wayne in 1976, told the BBC that the company should pay at a 50 percent tax rate.

Many of the tech giants, including Amazon and Google, have come under harsh criticism for not paying enough taxes.

"I don't like the idea that Apple might be unfair — not paying taxes the way I do as a person,” he told the broadcasting service. "I do a lot of work, I do a lot of travel and I pay over 50 percent of anything I make in taxes and I believe that's part of life and you should do it."

High US corporate rate

Apple, which is valued at over $600 billion, has come under pressure in Europe, where the company funnels its business through subsidiaries in the Republic of Ireland with a corporate tax rate of 12.5 percent.

The U.S. corporate tax rate is 35 percent.

Three years ago, the company admitted only paying a 2 percent tax rate for two Irish subsidiaries, helping the company amass about $200 billion in cash the U.S. government can’t touch.

In December of 2015, Apple agreed to pay $348 million to settle an Italian tax dispute.

"But you know, on the other hand, I look back at any company that is a public company, its shareholders are going to force it to be as profitable as possible and that means financial people studying all the laws of the world and figuring out all the schemes that work that are technically legal,” Wozniak, who left Apple in 1985, told the BBC. “They're technically legal and it bothers me and I would not live my life that way."