The U.S. central bank is poised to start pumping hundreds of billions of dollars into the American marketplace this week in hopes of boosting the nation's sluggish economy.

The Federal Reserve's policy-setting committee is meeting Tuesday. Economic analysts say that by Wednesday they expect the central bank will approve a plan to buy $500 billion or more in U.S. government securities over a period of several months.

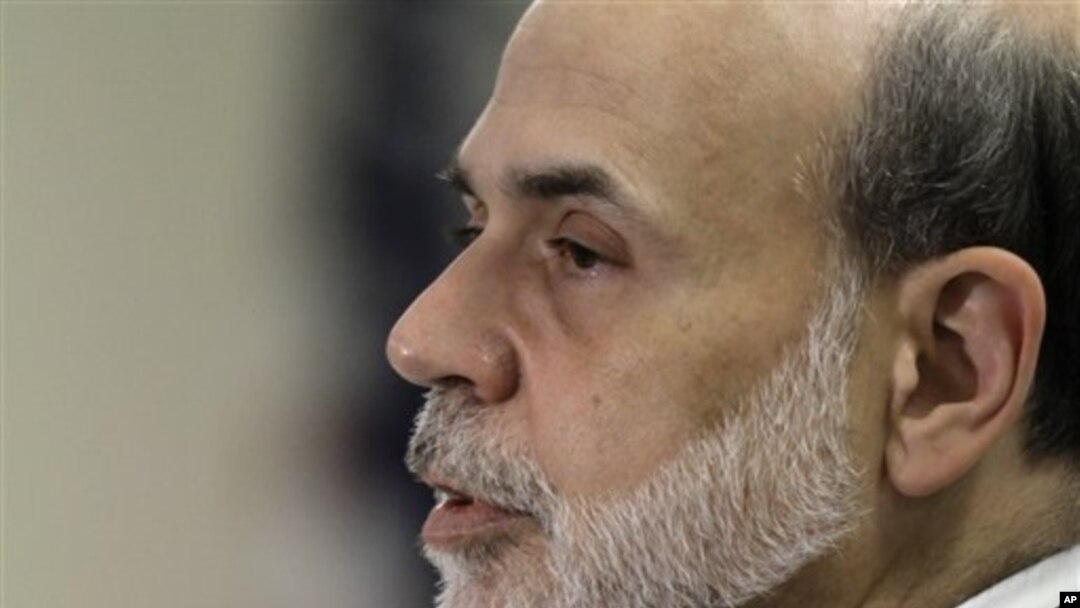

The idea behind the plan by Federal Reserve chairman Ben Bernanke is that the purchase of the securities will put downward pressure on long-term interest rates paid by businesses and consumers to borrow money.

That in turn could make it easier for consumers to increase spending, and for businesses to hire more workers. Almost one in every 10 U.S. workers is unemployed, or about 15 million jobless overall.

Critics say the Bernanke plan, virtually unprecedented in the Federal Reserve's policy-making role, might not have much effect on the U.S. economy. In addition, some analysts fear that pumping more money into the world's largest economy might be an over-reaction that could lead to long-term inflation.

Interest rates paid by businesses and consumers when they borrow money to buy homes are already at very low rates. But such low interest rates have not spurred significant economic growth in the U.S., even though the recession officially has been over since June 2009.

In the July-to-September period, the U.S. economy grew at a 2 percent annual rate, slightly more than the 1.7-percent expansion in the previous three months. But economists think that 3 percent growth is needed over a period of time before businesses would start hiring significant numbers of new workers.

In 2009, in the midst of the recession, the Federal Reserve bought $1.7 trillion in mortgage and treasury bonds. With the economy now growing modestly, analysts are predicting that the new purchase of securities might total at least $500 billion. By purchasing securities gradually, the central bank could review that action's effect on the economy before adopting other measures.

The two-day meeting of the Federal Reserve's policy-setting group, the Open Market Committee, begins on the same day as U.S. congressional elections, choosing all 435 members of the House of Representatives and filling 37 seats in the 100-member Senate. Opinion polls indicate that opposition Republicans are likely to regain control of the House and take seats from the majority Democrats in the Senate.

Republican control of even one of the congressional chambers could lead to further contentious debate over U.S. economic policy with President Barack Obama, a Democrat who does not face re-election until 2012.

Some information for this report was provided by AP, AFP and Reuters.